Swing trading is one of the most commonly used trading strategies that utilizes weekly or daily price movements in the financial markets. Swing trading differs from day trading in that the primary objective is to take advantage of medium-term prices and trends as opposed to short-term profits.

In this blog, we will have a detailed look at swing trading, contrasting it with day trading, going into different swing trading strategies. Moreover, analyzing its pros and cons so as to allow you to judge if it’s the most suitable for you to achieve your goals.

What are swing trading strategies?

Swing trading is an approach to trading that enables one to achieve short-term profits in a matter of days or even weeks by taking long or short positions in the market.

Contrary to day trading, where most decisions are made within the same day, swing traders keep their positions for the longer term. This gives them a great opportunity to capitalize on middle-term trends and price movements.

The main tool of swing traders is technical analysis in the detection of trading opportunities. Technical analysis applies the indicators and chart patterns to enter and exit trades without any emotional impact.

Difference between Swing Trading and Day Trading

Even though both swing trading and day trading concentrate on making a profit from short-term price movements, their approaches are quite distinct. One very important difference is that swing trading takes longer and involves trading once or twice a week. While day trading is made up of very frequent trades throughout the day that do not last more than a few minutes.

Day traders are usually active during one trading day. Their main target is intraday price changes and short-term trends. The former type of trader may hold a position for a few hours or up to a day.

While the latter type of trader may keep their position for several days or even weeks, taking advantage of the short-term trends and fluctuations. Swing traders use technical analysis to locate a trading opportunity and, hence, look into stock charts and indicators to make well-thought-out decisions.

Best Swing Trading Strategies:

1. Multi-Day Chart Patterns

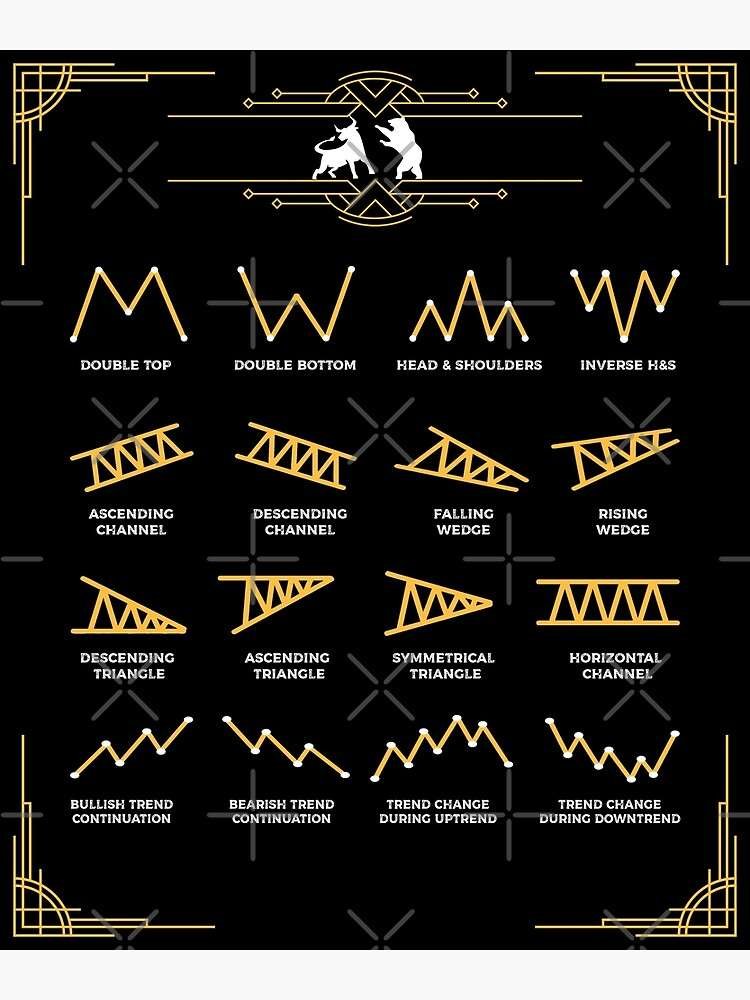

Multi-day chart patterns are technical formations that develop over several days, and due to them, the price movement can be termed. Besides the triangles, flags, pennants, and head-shoulder patterns, the common multi-day chart patterns are also found.

The patterns provide signals for consolidation or continuation and present traders with windows of opportunity for entering or exiting the market.

2. Moving Averages Crossovers

Probably, swing traders utilize a lot of moving averages to eliminate the ability of trends and reversal points. When a shorter-term moving average crosses the longer-term one from below, an upward crossover occurs.

Similarly, when a shorter-term moving average crosses the longer-term one from above, a downward crossover takes place, pointing to a potential change of trend. Swing traders use moving average crossovers to rectify trend reversals and identify entry and exit branches for their deals.

3. Fibonacci Retracement

Fibonacci retracement levels are utilized by swing traders for finding out possible regression and resistance zones of the market. These lines are planned according to the Fibonacci sequence and are made between the prices of a chart.

Swing traders apply Fibonacci retracement levels to spot possible turning points and then choose a trading strategy that aligns with them.

4. Bollinger Bands Method

Another swing trading strategy is Bollinger bands; they are a technical indicator. It consists of three lines: an up band, a down band, and a middle band. The middle band is the simple moving average most of the time.

It represents the average price over a specific time period, while the top and bottom bars show volatility. Swing traders use Bollinger Bands to identify overbought and oversold states in the market and to anticipate possible price changes.

5. Trend-Catching Strategy

The trend-following approach is concerned with the pick-up and exploitation of certain mid-term cyclical trends. Swing traders rely on technical indicators such as moving averages, MACD, or RSI to analyze trends. The purpose of this strategy is to sustain a position until the trend reverses, enabling traders to accumulate profits.

Given the constant changes in trends, traders are required to be alert all the time. Through the proper management of trends, swing traders have the chance to catch moves. This is especially the case when prices are at their all-time high.

6. Fading Trading Strategy

The strategy is long-term and is based on trading against. And this is the reason why it is often called “don’t hide it,” harnessing the short-term overreaction and coordinated buying.

It’s also viewed as a high-risk strategy, which explains the use of such techniques by expert traders. They know the potential risks of trading against market development.

Advantages of using Swing Trading Strategies

Swing trading permits the traders to recognize the short-term price movements. In a really short time, there is possibility to maximize their potential profit.

Contrary to day trading, swing trading enables investors to trade for several days or weeks. Thus decreasing the amount of time dedicated to trading activities.

Swing trading provides a sort of flexibility in capital management that enables traders to do capital allocation prudently and handle risk successfully.

Risks of Swing Trading Strategies.

The weekend and overnight volatility may produce a gap or price fluctuation, which can be a surprise when the market opens.

Swing traders are prone to headline risks as unceded news events and developments in the market can suddenly trigger large price movements.

Swing trading, which does not require much time commitment, usually requires technical skill. These skills include the use of technical indicators and chart patterns, which are complicated and difficult for novice traders to master.

Should you adopt a swing trading strategy?

Whether you decide to go with swing trading has to do with what your trading targets are, how comfortable you are with risks, and how much trading experience you have. Swing trading offers a chance to derive a short-term profit, and it gives you flexibility in trading.

Nevertheless, swing trading is also associated with certain risks and calculations. Traders need to assess their risk management skills and be able to perform trades efficiently before incorporating swing trading strategies.

Furthermore, it is also important to examine the concept of swing trading to determine. Whether it corresponds with your long-term investment goals and risk tolerance.

Conclusion

In a nutshell, swing trading provides traders with an adaptable approach to take advantage of the short-term price oscillations in financial markets. Placed in between day trading and long-term investing, swing trading supplies traders with opportunities to make profits from swings and trends that take place in the medium term.

A variety of swing trading strategies are used by traders so as to identify the right trading opportunities and execute their trades precisely. In the end, whether one goes for swing trading strategies depending on his or her trading goals, risk tolerance, and expertise or not is his or her own call.

With discipline and a tactical approach, swing trading may be a useful concept for a trader, providing opportunities for only short-term profits.

FAQs:

Can a beginner become a successful swing trader?

Yes, if newcomers are dedicated and willing to learn, they can succeed too. Start from the basics, practice by means of small investments and then by gaining experience to build your way to success in swing trading.

How much time do I need to devote to swing trading?

It varies from one case to another, but routine watching is usually needed. One of the rare occasions where swing traders are successful is when they are able to spend a lot of time each day looking at market trends, doing research for potential trades, and managing their positions.

What are some common mistakes to avoid when swing trading?

Do not make an over-trading mistake because it may result in more losses. Furthermore, the principles of risk management are often neglected and giving in to emotions and allowing them to dictate the direction of the trades is a common error. It is important to keep a sound strategy and for perseverance.

Is Swing Trading Suitable for Part-Time Traders or Those with Full-Time Jobs?

Yes, swing trading is an option for part-time traders holding full-time jobs or otherwise. If properly organized, observed, and in contrast with other financial activities, swing trading is suitable even for those who have other important engagements

How Can I Develop a Successful Swing Trading Strategy?

The swing trading strategy is not successful without mastering the technical analysis techniques, such as the chart pattern and the indicator. It as well involves testing and adjusting strategies in simulated trading or small-scale live trades too.

Where Can I Find Reliable Resources and Tools for Swing Trading?

Trustworthy resources for swing trading include books, online courses, and systems with good analysis. Consequently, trading online platforms and communities give you the much-needed support as well as analysis.